Copper ETF: Smart Play in a Bull Market

Dec 15, 2024

Introduction: Copper ETF: A Bullish Bet in the Commodities Market

The global commodities market remains a dynamic arena for investors, with copper as a promising opportunity. As we progress through 2024, several key factors remain compelling for investing in copper and copper ETFs.

Copper’s role in various industries, such as construction, power generation, electric vehicles, and renewable energy, underscores its importance. Its properties, including high electrical and thermal conductivity, durability, and recyclability, make it indispensable.

Recent data from the International Copper Study Group (ICSG) indicates a growing deficit in copper supply. The deficit was 435,000 tons in 2023 and is projected to increase to 550,000 tons in 2024 and 650,000 tons in 2025. The rising global demand for renewable energy and electric vehicles drives this shortage.

Copper extraction and production are lengthy processes, often taking over a decade from discovery to operational mining. This delay means that even newly discovered deposits won’t alleviate the supply shortage soon. Environmental concerns, regulatory hurdles, labour issues, and technical difficulties also challenge copper production.

Given these factors, investing in copper ETFs is a strategic move. Copper’s critical role in the transition to renewable energy and its importance in various industries make it a valuable commodity. The potential for supply disruptions and projected deficits further strengthen the argument for securing exposure to copper.

Why Copper ETFs?

Investing in copper directly can be risky due to the volatility of individual companies. Copper ETFs offer a safer alternative by providing exposure to the copper industry without investing in particular stocks. They track the performance of copper futures or companies involved in copper mining, offering diversification that helps mitigate risk.

Copper ETFs allow investors to capitalize on the bullish copper market without understanding the complexities of futures contracts or the specific risks associated with individual mining companies. Popular options include the Global X Copper Miners ETF (COPX), which provides global exposure to a wide range of copper mining companies, and the United States Copper Index Fund (CPER), which tracks copper futures contracts.

Navigating Market Trends: The Copper Perspective

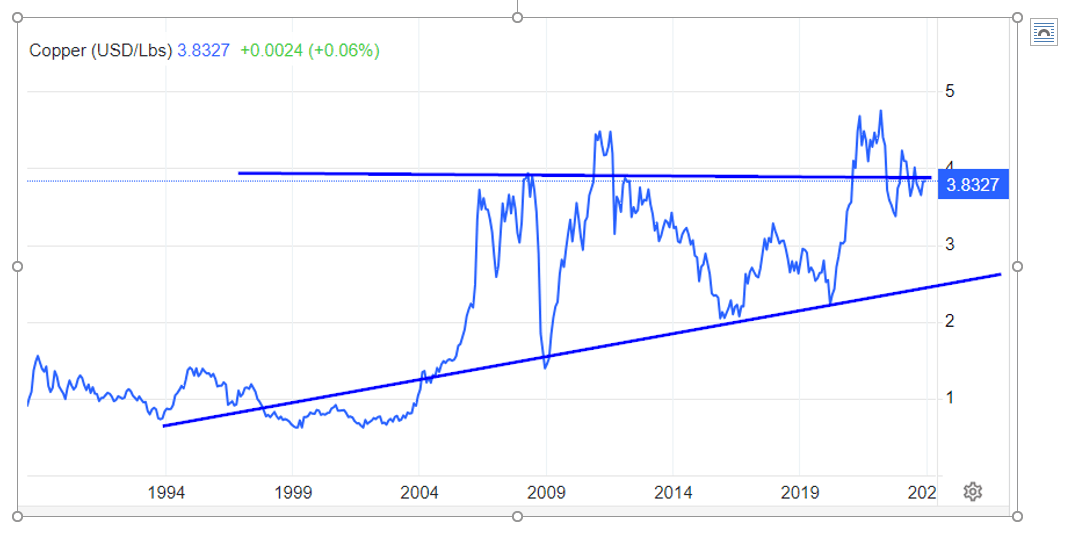

Understanding market trends is crucial for investors. Copper has historically been a leading indicator of market fluctuations. Its upward trajectory suggests stability unless it dips below a critical price point. The guiding principle for investors remains: “Buy the crash and dismiss the clamour of uncertainty.”

From a behavioural psychology perspective, the allure of copper ETFs can be attributed to loss aversion. Investors are often more motivated to avoid losses than to achieve equivalent gains. The projected deficits and potential supply disruptions in the copper market create a fear of missing out (FOMO) on potential gains, driving investors towards copper ETFs to hedge against future shortages. Additionally, the bandwagon effect may come into play, where investors follow the trend of increasing copper demand, reinforcing the bullish sentiment in the market.

The guiding principle remains steadfast: “Buy the crash and dismiss the clamour of uncertainty.”

Copper’s Symphony: Harmonizing Investment Strategies

Copper, often overshadowed by the allure of cryptocurrencies and AI stocks, emerges as an unsung hero. Unveiling a compelling long-term investment narrative, Copper stands resilient amid the clamour for futuristic assets. A critical juncture approaches as demand for Copper, coal, and uranium intensifies, laying the groundwork for a potential mega-trend.

The narrative unfolds with profound simplicity: rising demand for Copper is poised to outstrip the available supply. The International Copper Study Group (ICSG) projects a significant deficit of 510,000 metric tonnes in the global copper market for 2024, starkly contrasting with the 2021 surplus of 600,000 tonnes. This shift is propelled by the swift expansion of industries reliant on Copper, notably in electric vehicle manufacturing and renewable energy solutions. The World Bank anticipates a more than thirtyfold increase in electric vehicle production by 2030, driving a 1.9% annual rise in Copper demand until that pivotal year.

Copper ETF: Simple Way To Bet On Copper

In 2022, copper prices hit record highs, indicating that the global economy was not in a dire state but rather a result of poor political decisions by world leaders. Despite a brief setback, copper remained steady and surged beyond the 4.50 mark, revealing that inflation and supply were merely symptoms of bad policies, with the United States policies being a prime example.

As a result, copper is gaining momentum and is set to trade past 4.50; this also means that the market will be range-bound for years, posing a challenge for long-term investors who focus on indices. However, this presents an excellent opportunity for traders who can use market psychology and technical analysis to their advantage.

Moreover, with the world moving towards renewable energy sources, copper will be in high demand for the production of solar panels, wind turbines, and electric vehicles. The need for copper is expected to increase with the global economic recovery, particularly in China, the world’s largest consumer of copper.

Copper Shortage: A Prolonged Challenge with Solutions in Supply Boost

Shortages will affect The copper market for a long time unless immediate action is taken to address the supply shortfalls. The key lies in increasing exploration and mining activities. However, establishing new mining operations is a slow and intricate process. Consequently, copper demand is expected to exceed supply for an extended period.

According to Robin Griffin of Wood Mackenzie, unrest in Peru and rising demand from the energy transition sector are projected to cause significant deficits in copper supply until 2030. Peru’s protests have led to the closure of mines, affecting its 10% global copper supply contribution. Chile, the leading copper producer at 27%, has also witnessed a 7% year-over-year decrease in output. Despite these disruptions, experts like Timna Tanners anticipate the emergence of new mines in 2023. The reopening of China and the growing demand from the energy transition are straining copper resources, and the supply deficit might persist until 2024-2025, potentially doubling copper prices. Electrification, particularly in electric vehicles (EVs) and charging infrastructure, drives up copper demand due to their high usage of copper. The growth of the energy transition poses a significant long-term challenge to copper supply.

McKinsey predicts global electrification will increase copper demand to 36.6 million tonnes by 2031, while the estimated supply stands at 30.1 million tonnes, resulting in a 6.5 million tonne deficit. The utilization of copper in green technologies is expected to rise from 4% in 2020 to 17% by 2030. Achieving “net-zero emissions” would require an additional 54% of copper. S&P Global envisions demand approaching 50 million tonnes by 2035, but even with mining output growing at 2.69% annually, it would only reach 31 million tonnes. Experts emphasize the current and future supply gaps driven by the surging demand from EVs, renewables, and electricity grids. The copper market is grappling with tightening supply constraints and a substantial gap over the next decade.

Conclusion

In conclusion, investing in a copper ETF can be a wise decision, as copper is an essential commodity in various industries. With the global economy recovering, its demand is likely to increase. Copper prices are expected to rise while the US dollar is projected to stay at a multi-year high, triggering inflationary forces. Moreover, the current copper market presents an excellent opportunity for traders who can use market psychology and technical analysis to their advantage.

An excellent approach to capitalizing on the copper situation, especially if you prefer not to invest in copper stocks, is to consider one of the following ETFs. The global miners’ ETF is somewhat more volatile but provides the best opportunity to achieve the highest gains in the ETF sector.

Here is the list of copper ETFs:

1. iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC)

2. United States Copper Index Fund (CPER)

3. Global X Copper Miners ETF (COPX)

Please be aware that the availability of these ETFs may vary.

Now for the historical outlook

In the good old days, before QE changed everything, any signs of strength from copper could be construed as a positive development for the markets and vice versa. However, based on the price action of copper, the US markets should have crashed long ago, but they diverged strongly. Propped by hot money, the markets continued to soar higher. One wonders what will unfold when copper is finally put in a bottom. Market Update Oct 2nd, 2015.

The Fed’s success in manipulating the market and recreating reality has been awe-inspiring. The masses have been hypnotized and have swallowed their narrative whole, making it all the more likely that copper and the markets will rally together. This will only reinforce the illusion that everything is hunky-dory and that the economy cannot function without the Fed’s omnipotent intervention.

But make no mistake, dear reader. There are two distinct forces at play here. On one hand, the elite players are cunningly culling the herd, taking out the intermediate players and making way for their grand designs. On the other hand, some refuse to be deceived and struggle to survive in this cutthroat environment. It’s a battle for survival, and only the strongest and most adaptable will come out on top.

Copper ETF Stock: Good Hedge Against Hot Money

In reality, those in power are manipulating the masses for their gain and doing it with nothing short of masterful finesse. The so-called “big players” are being taken out left and right, but it’s all part of a larger plan that is carefully hidden from public view. Meanwhile, a new psychological test is underway to see how much the masses will accept before they push back. The results so far are both fascinating and terrifying.

The powers that be have no interest in allowing natural economic forces to work out the excess in the system. Instead, they create money out of thin air, perpetuating the illusion of economic growth and lining their pockets. The rich get richer while the average person struggles to make ends meet.

But why bother with anything else when the masses remain complacent? The people are distracted by many issues, from immigration to economic woes, and the truth is often hidden in plain sight. The governments of Europe, for example, created an environment in which Muslim immigrants could invade, and now they’re using that as a smokescreen to hide their true intentions.

The situation in the US is no different. The powers that be are pulling the strings, and they’re doing it with a finesse that is both impressive and terrifying. Things will not end well if the people don’t wake up soon. The illusions will crumble, and the truth will come out. But will it be too late to do anything about it?

Other Stories of Interest

The Lavish Tale of the Dot-Com Bubble: When the Internet Took the World by Storm